The Changing Indirect Tax Environment

The Indirect Tax area is constantly changing as we have seen by the implementation of VAT taxes in the Gulf States for the first time and the Wayfair U.S. Supreme Court case fallout that is drastically changing sales taxation in the United States. Unfortunately, resourcing and training in most organizations is deficient in this area which can lead to unintended problems. In light of developments over the last year greatly increased audit activity will also be forthcoming.

The Indirect Tax Diagnostic Review is a general review and evaluation of the administration of the transaction tax function. The primary objective is to identify areas of potential transaction tax non-compliance. This process will consist of a Diagnostic Review and Diagnostic Report.

Effectively Managing Your Indirect Taxes

Upon performing our diagnostic review, CAT will identify your Indirect Tax challenges, our team will formulate a plan specific to your company’s needs and then collaboratively determine the best path forward. Your organization can achieve operational efficiencies and other benefits such as:

- Ensure compliance and reduced costs of compliance and audit support

- Allow tax resources to better focus on higher value activities such as business advisory and planning

- Improving visibility of Indirect Tax compliance to the rest of the organization

- Aligning processes, tools and applications such as JDE and supporting multiple third-party tax tools

Maximize your JDE Indirect Tax Solution

Organizations are continuously looking to streamline their operations and reduce costs. Although JDE has built-in functionalities, when installed out of the box, it undergoes very little tax optimization and may not fully meet all of the tax requirements. With the results of the CAT Indirect Tax Diagnostic we can identify these problem areas and recommend our solutions. Your company’s associated cost savings can be significant.

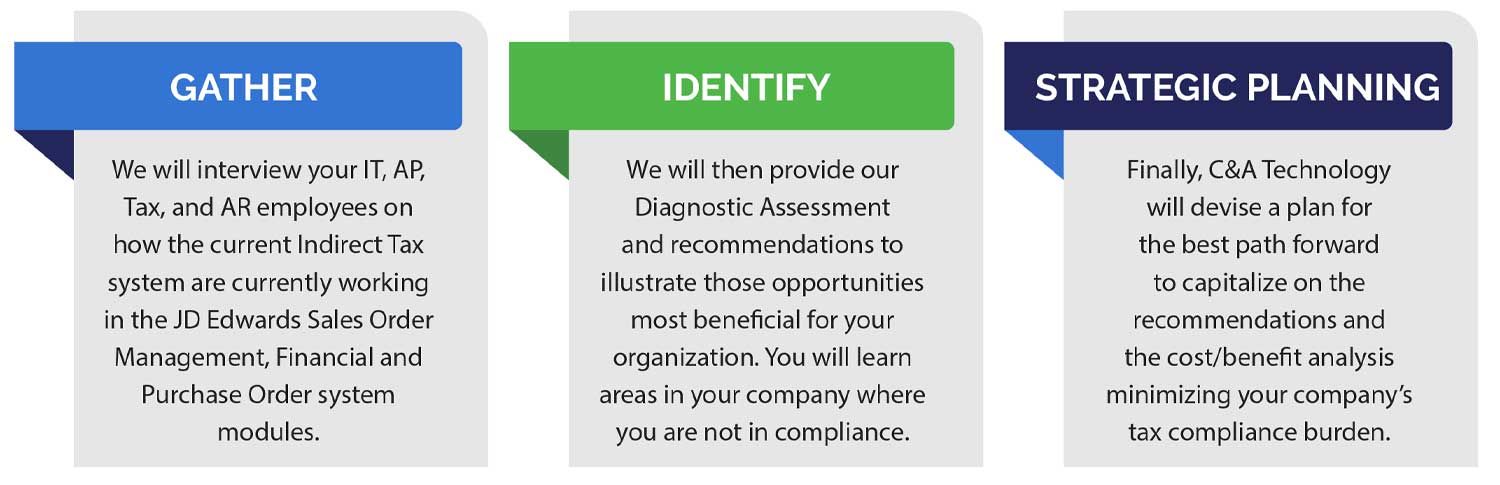

We do this in three simple steps.

Reduce Tax Operational Costs While Maintaining & Improving Quality

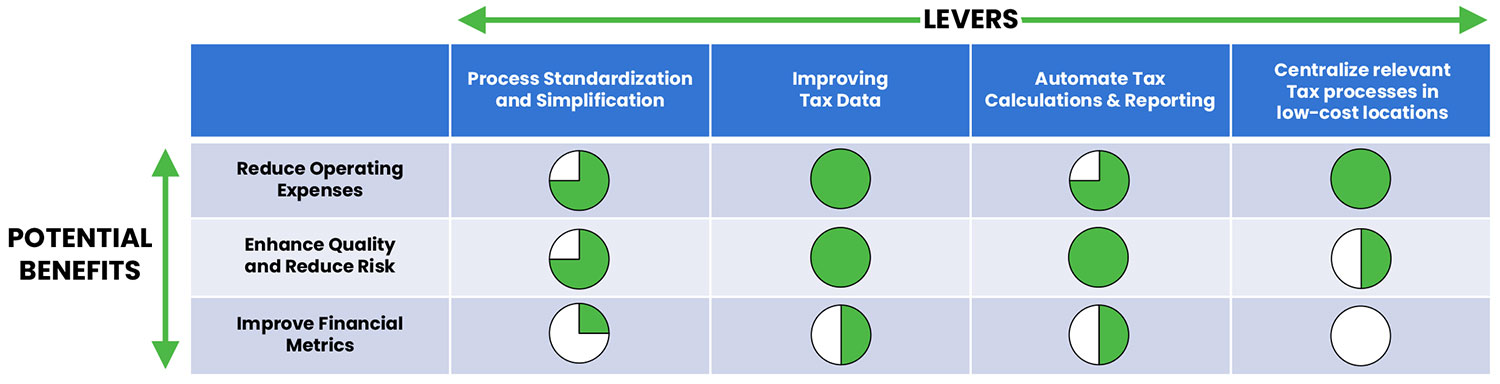

Using a combination of levers as seen below, companies may reduce an estimated 25-40% of the overall operational costs of the Indirect Tax function.

Benefits of the Indirect Tax Diagnostic

Our goal is to identify your Indirect Tax areas of non-compliance which could help you achieve more effective and efficient operations. After our review, together we will develop a road map/strategy which will improve your bottom line and save your company valuable time and effort. Our goals for the diagnostic is to:

- Understand your high-level Indirect Tax processes by conducting workshops, web-meetings and reviewing documentation

- Provide guidance on the best approach to insure Indirect Tax compliance

- Design a road map that details steps needed to reduce your liability and train key employees on how to achieve improved management of Indirect Taxes

Learn More

Get more information about CAT’s Indirect Tax Diagnostic for JD Edwards by clicking the PDF link below.

Download PDF Now

Contact Us

There are five (5) ways to find out more about CAT’s products and solutions for your ERP system.

- Call us at +1-844-533-4228

- Click on the CHAT BUBBLE on the bottom right.

- E-mail us at info@catechnology.com

- Fill out the CONTACT FORM on this page to send us a request for more information.

- Or simply select an available time that works for you from the calendar below to BOOK A MEETING.

Either way, we would love to hear from you.

* Mandatory Fields.

C&A Technology LLC will not share your personal information without your consent.