CAT Global Support Services

As a U.S. company running SAP® software with Global subsidiaries, global support and localizations can be a double-edged sword. You need to remain compliant with the financial laws of each country - from a country, state/province, and even a regional perspective. The specifics vary so much from country to country that the process can be tedious, painful, and a bit intimidating. In addition, several countries regulate industries differently by industry.

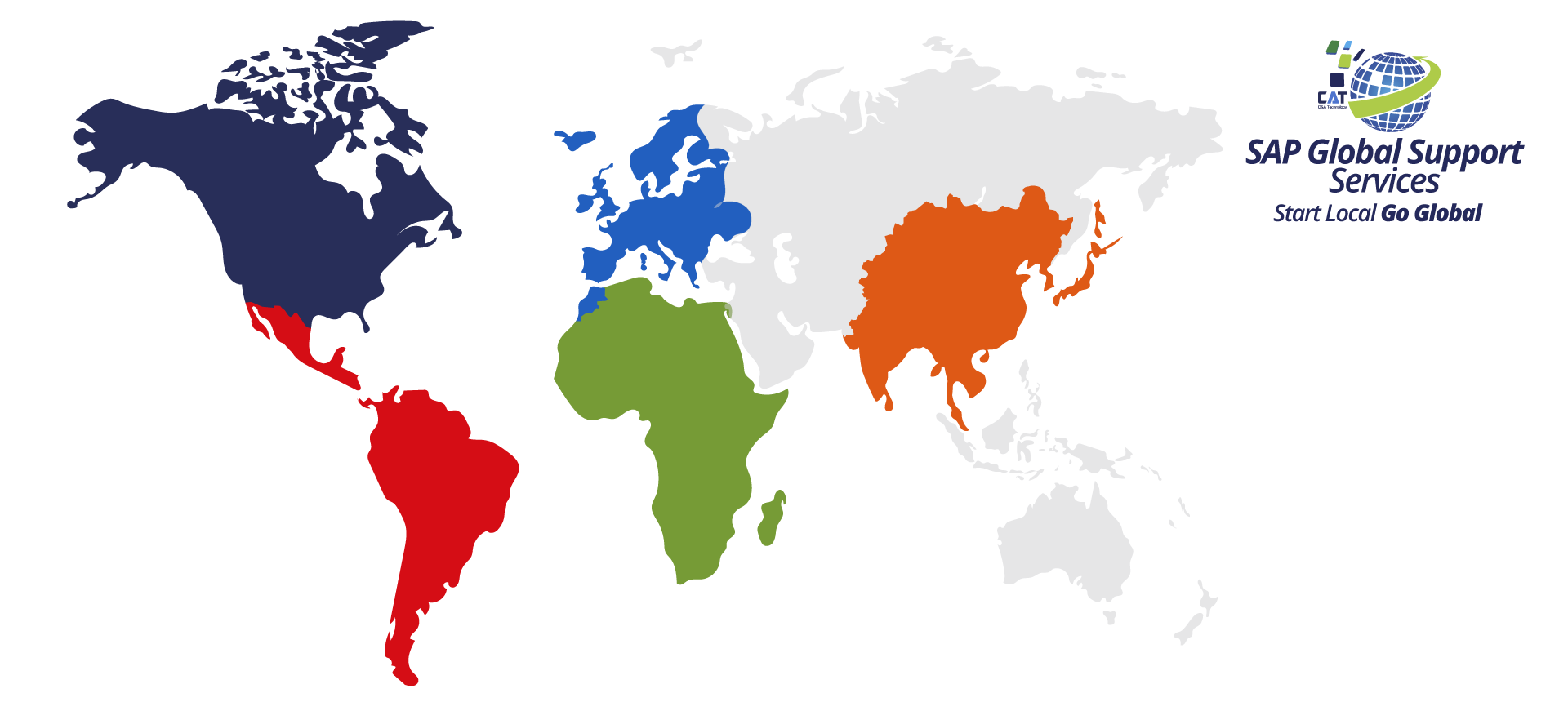

CAT SAP® Global Support Coverage

CAT allows our Global SAP® customers to receive truly local resource support in the countries outlined below.

CAT Localization Support Services

For any SAP® software localization there are three primary areas of involvement: chart of accounts, local tax register validation, and the daily exchange rate. This means that you need localized templates to map your SAP® ERP system for each country in which you are operating. This includes business functions around Accounting, Financial Reporting, Materials Management, Sales and Distribution, Invoicing, and Payments. Your data not only needs to be accurate but must also map to government-run reporting standards, submitted proactively, and available electronically for review by country/regional authorities.

For the SAP® localization process, CAT can assist you with:

Localization Best Practices

Legal & Tax Updates

Accelerated Compliance

Global SAP® Expertise

Local Expertise

Transparent Integration

3 Major Components of a Successful SAP® Global Localization

Global Accounts Standardization

Local Tax Compliance

Currency and Language Updates

Global Chart of Accounts, Local Policy

In many countries, the chart of accounts is defined from a standard, general layout or as regulated by law from a country, state/province, and regional perspective depending on the country.

The main objective of this standardization is to provide accounting information in a structured manner and to fulfill accounting objectives and facilitate the control of all income and expenses by country authorities. The chart of accounts also helps each country collect statistical information that helps evaluate the benefit or social impact of all economic activities within the country.

How CAT Helps:

When conducting an SAP® global localization, there are three important factors to consider: the legal chart of accounts, local tax register validation, and fluctuating daily exchange rates. Here is how CAT can help make your localization process smooth and accurate.

- Provides templates for most global countries to easily map the company’s information with legal requirements

- Preconfigures legal reporting

- Covers global country reporting needs

Local Tax

Vendor/customer withholding master data must be validated and periodically updated to match the stored information within each global country’s tax register. This applies to tax registers at both the country and state levels and involves:

- Creating an invoice (customer)

- Making a payment (vendor)

- Making a down payment

How CAT Helps:

- Audits and validates withholding master data to make sure it matches the country’s tax register

- Updates this information in SAP® to ensure the latest data is captured in your ERP system

Local Currency, Language

Global countries are constantly adjusting exchange rates, which change daily. Rates are published by each country’s National Bank, which can be challenging if your organization is operating in multiple countries.

- Creating an invoice (customer)

- Making a payment (vendor)

- Making a down payment

How CAT Helps:

- Provides automatic updates on exchange rates as they are published by each country’s National Bank

Ready to learn more?

Download more information about CAT’s SAP® Global Support Services. Fill out the form below and we’ll email you the link.

Contact Us

There are five (5) ways to find out more about CAT’s products and solutions for your ERP system.

- Call us at +1-844-533-4228

- Click on the CHAT BUBBLE on the bottom right.

- E-mail us at info@catechnology.com

- Fill out the CONTACT FORM on this page to send us a request for more information.

- Or simply select an available time that works for you from the calendar below to BOOK A MEETING.

Either way, we would love to hear from you.

* Mandatory Fields.

C&A Technology LLC will not share your personal information without your consent.